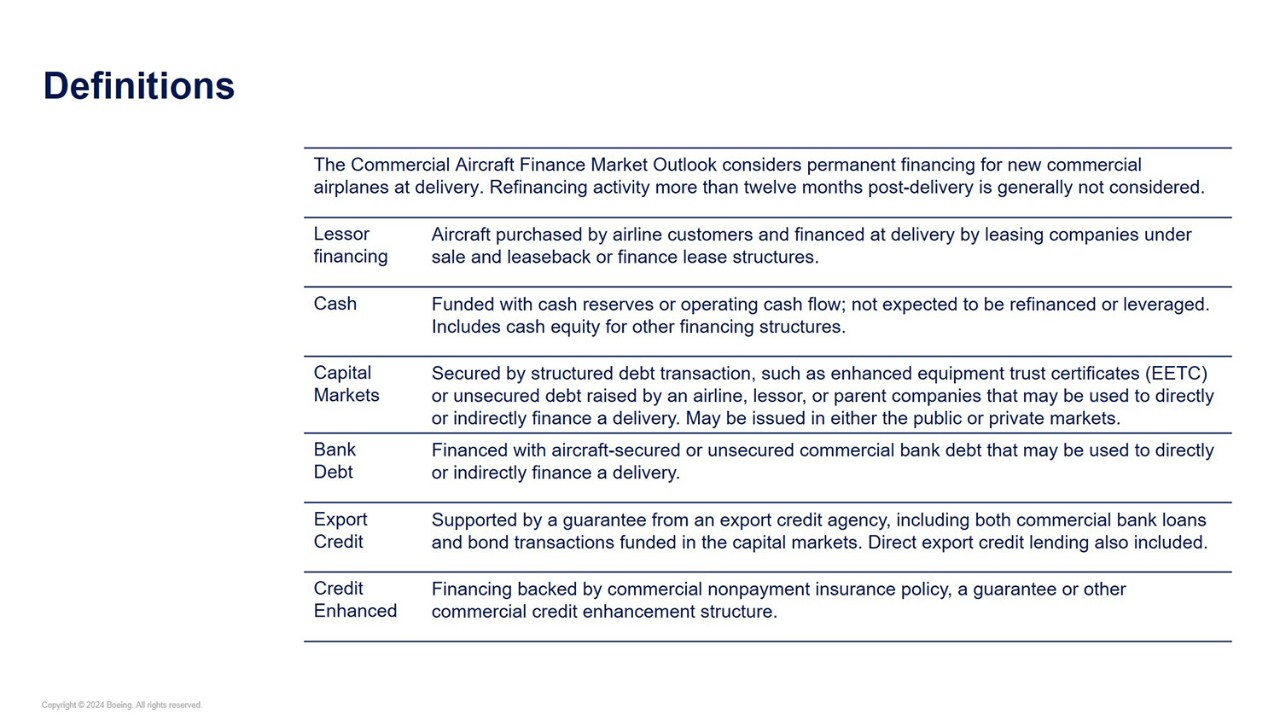

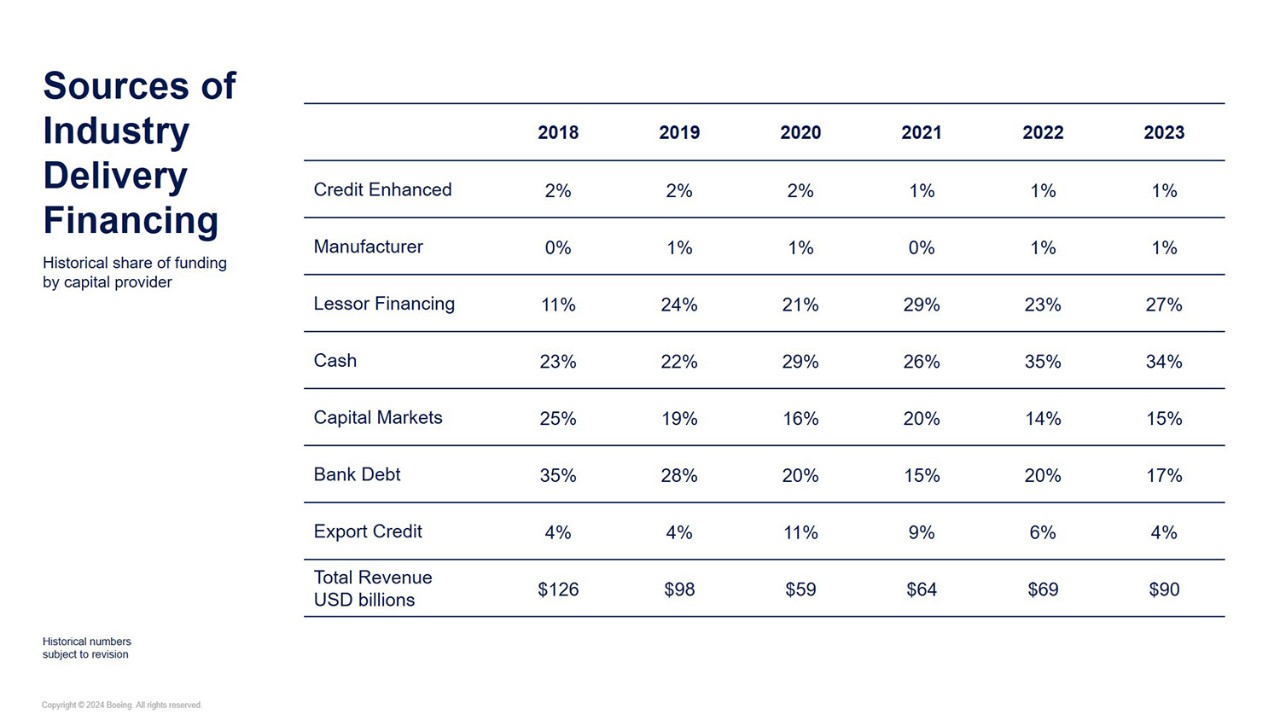

Boeing Commercial Airplanes Customer Finance created the Commercial Aircraft Finance Market Outlook (CAFMO) to provide an analysis of the sources of financing for new commercial airplane deliveries (for aircraft 90 seats or above).

Global Financing Trends

- Industry Delivery Funding

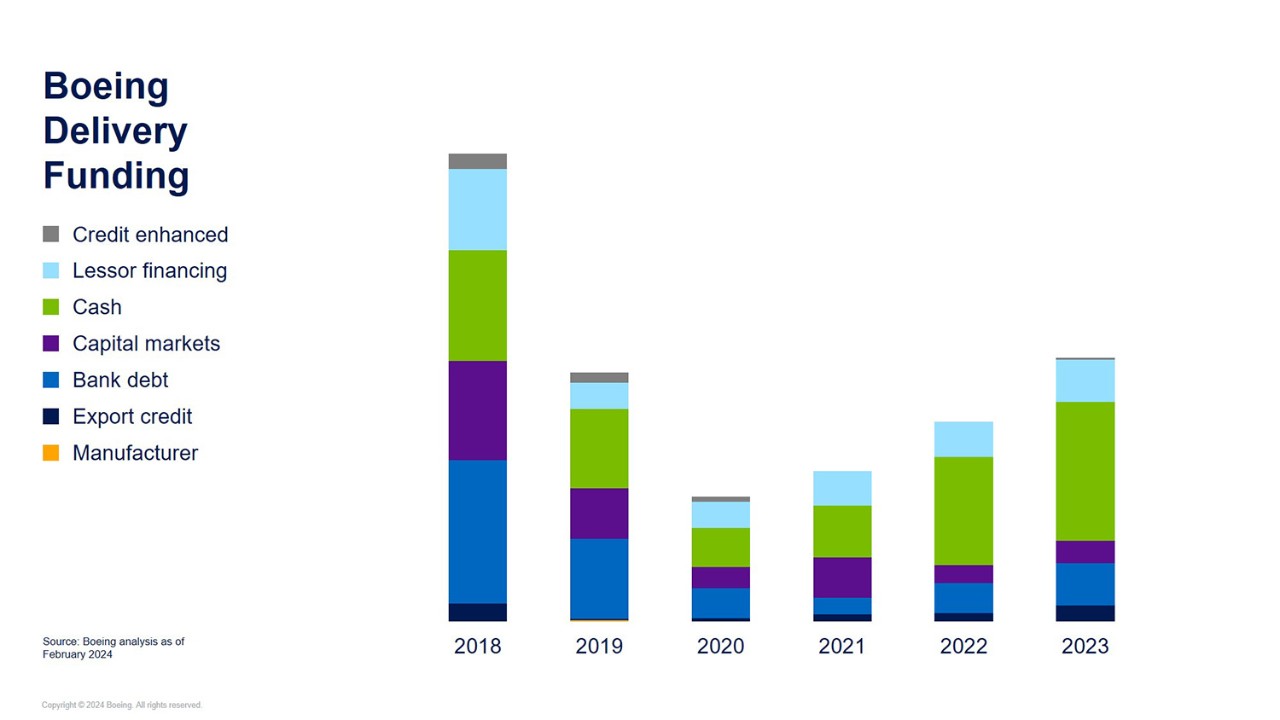

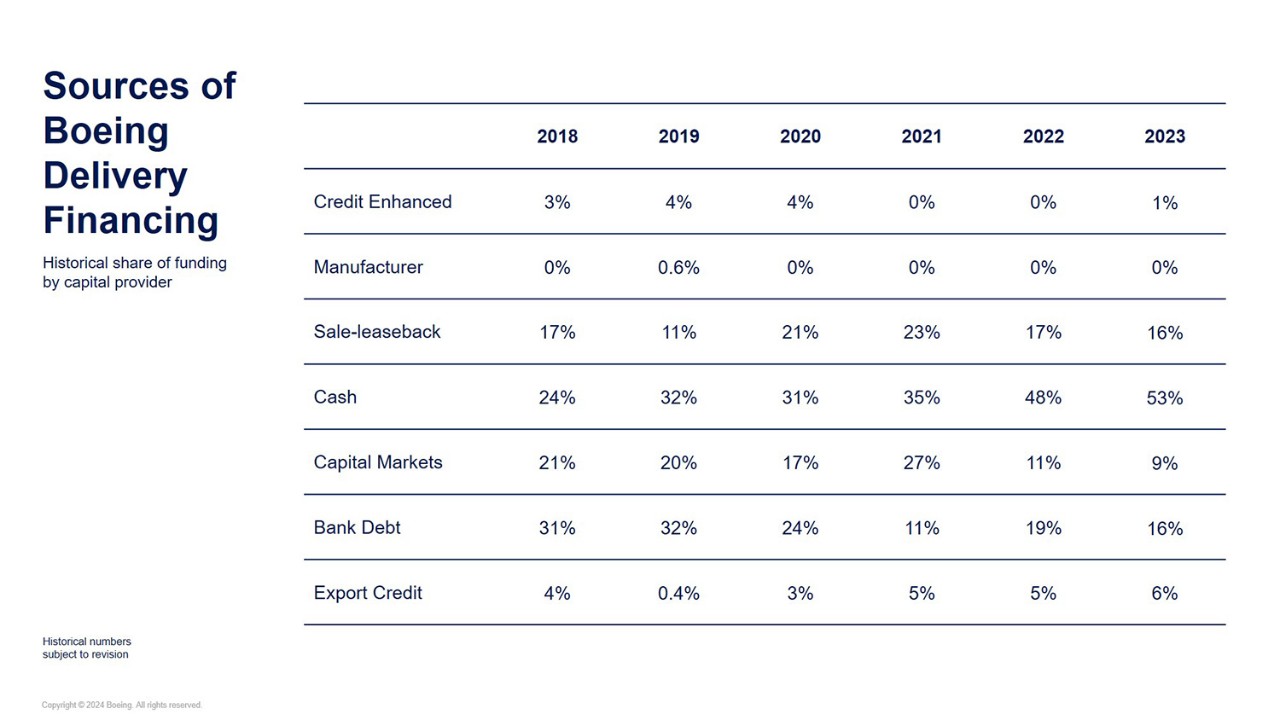

- Boeing Delivery Funding

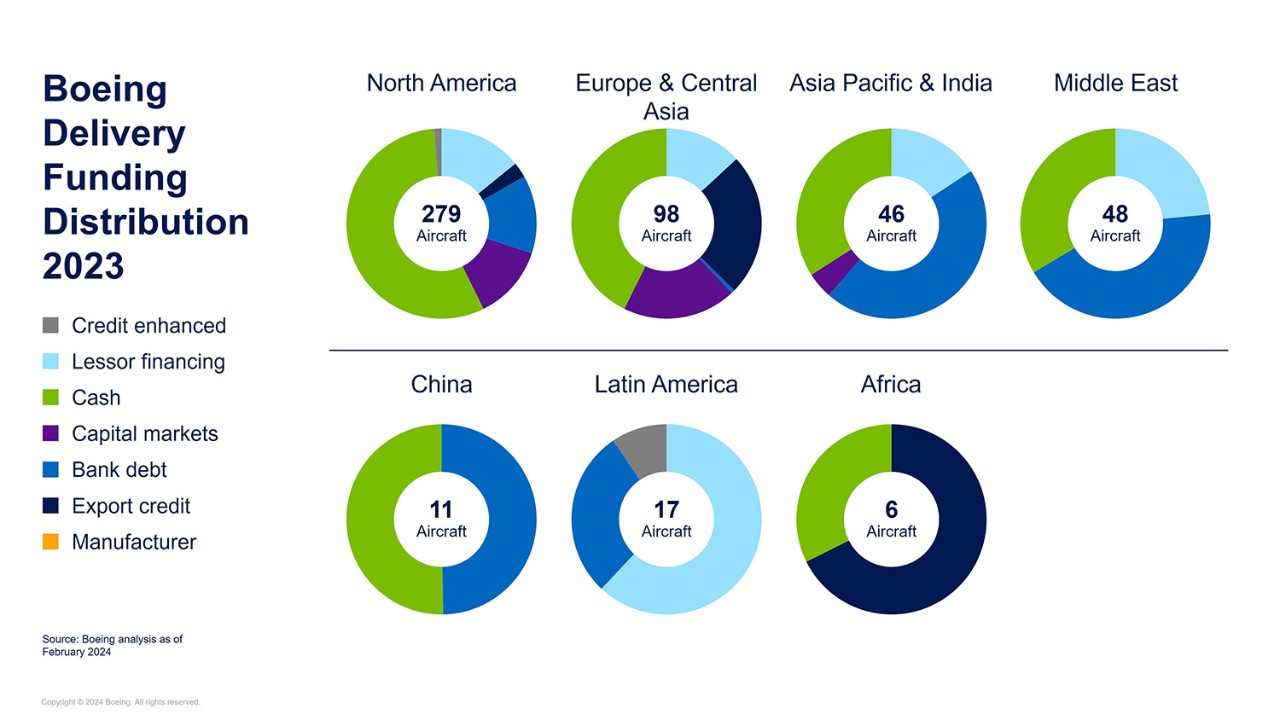

- Boeing Delivery Funding Distribution 2023

Financial Product Distribution

Regional Finding Insights

- North America

- Latin America

- Asia Pacific & India

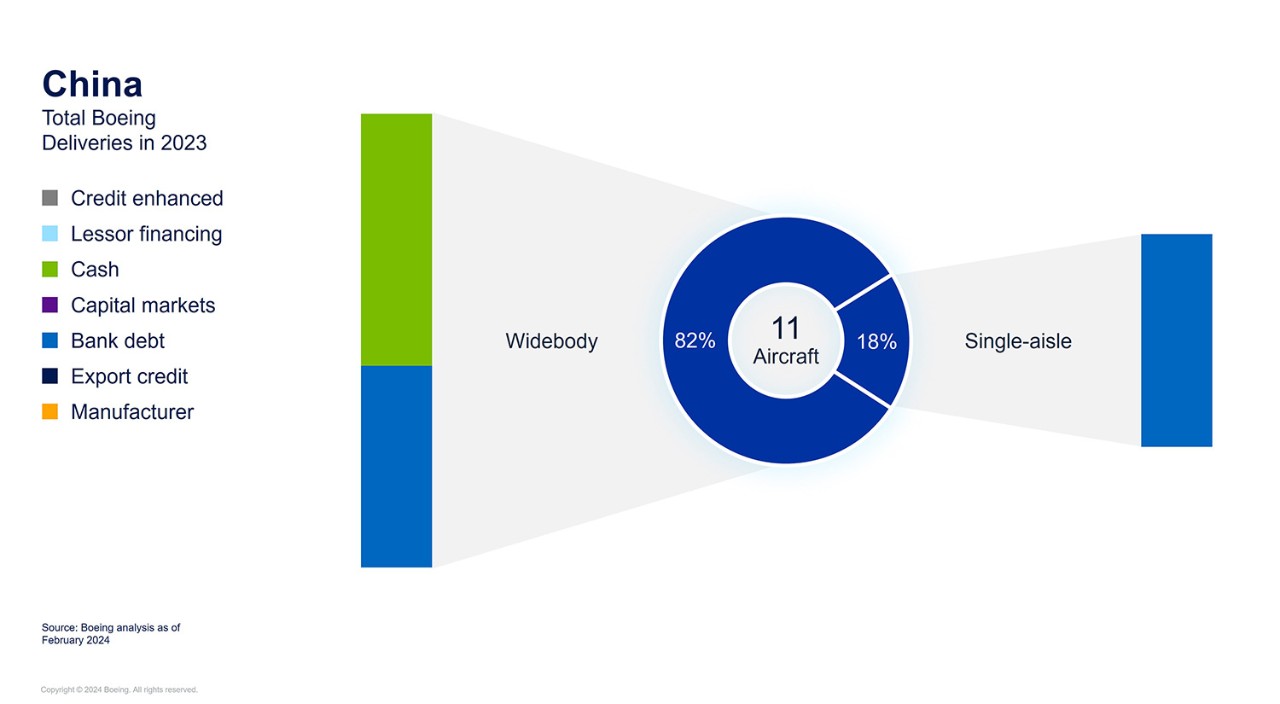

- China

- Europe & Central Asia

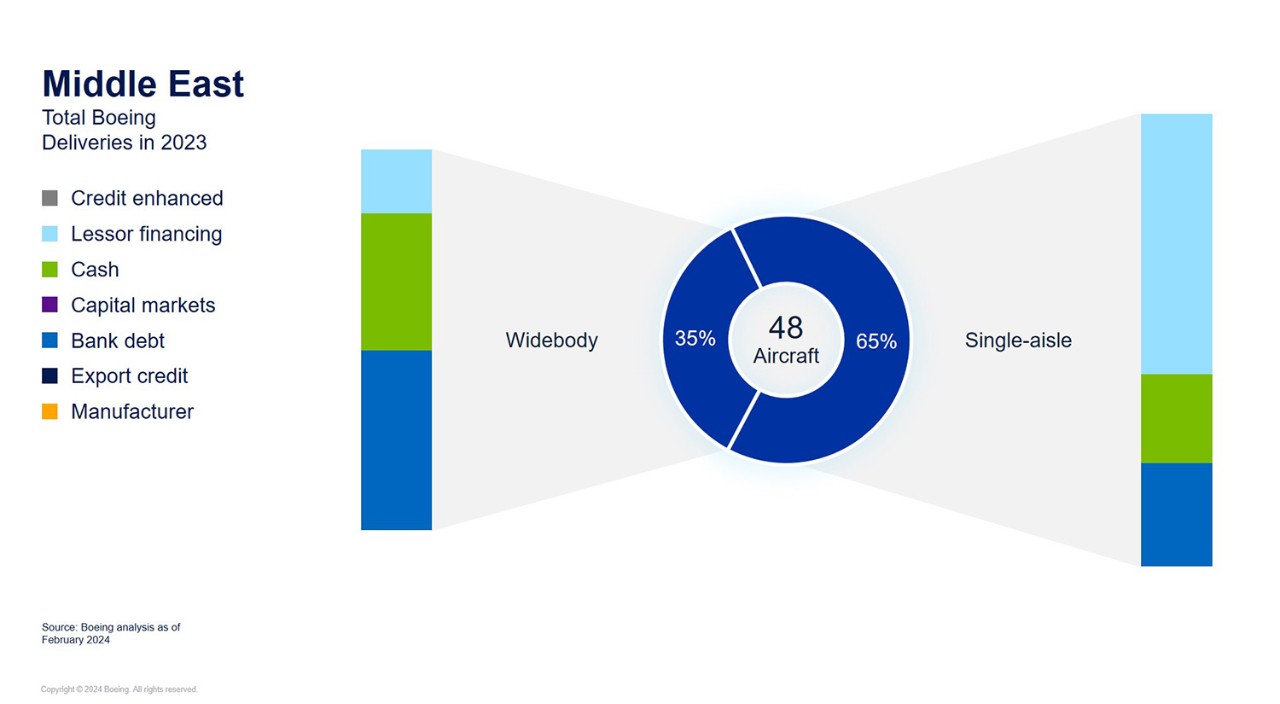

- Middle East

- Africa

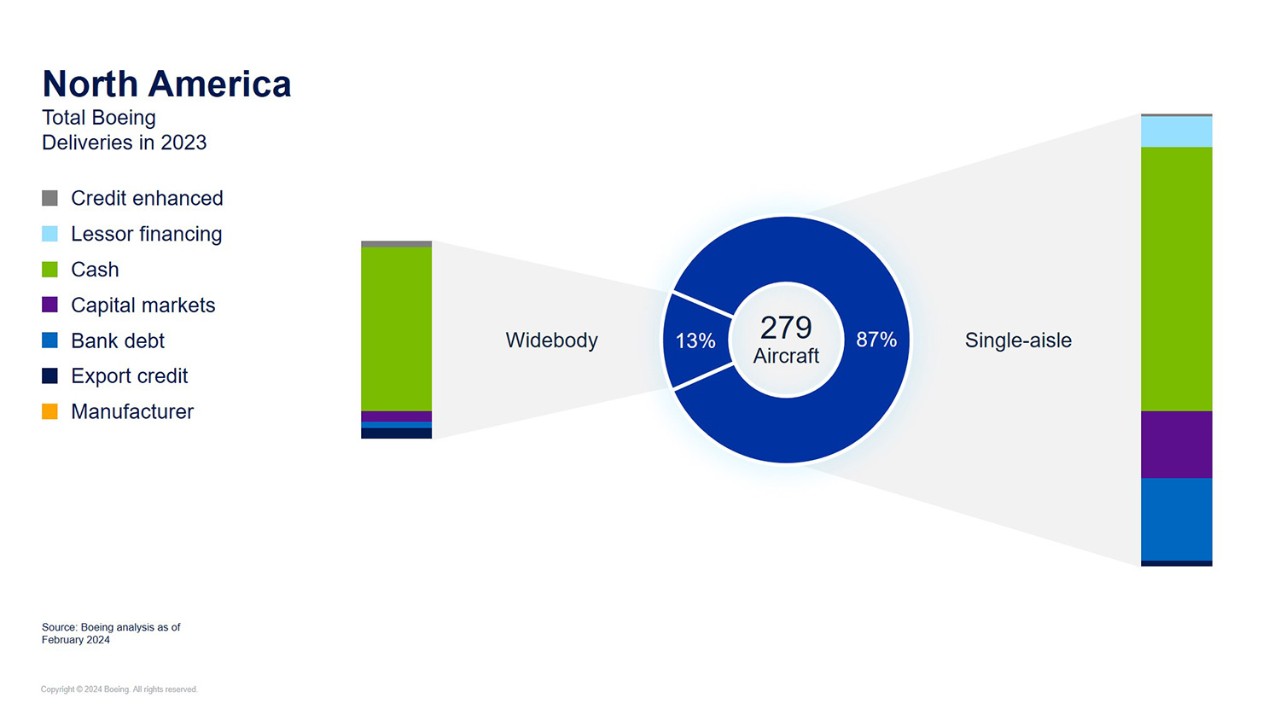

North America

Cash was the predominant source of funding in 2023 for North American-/U.S.-based carriers. A combination of higher interest rates and healthy operating results are pushing many North American airlines to continue focusing on deleveraging. Use of delivery financing expected to increase from 2023 but remains below historic levels.

Airline preference for owning aircraft will lead to continued innovation from lessors and credit markets, particularly if capital markets usage remains muted.

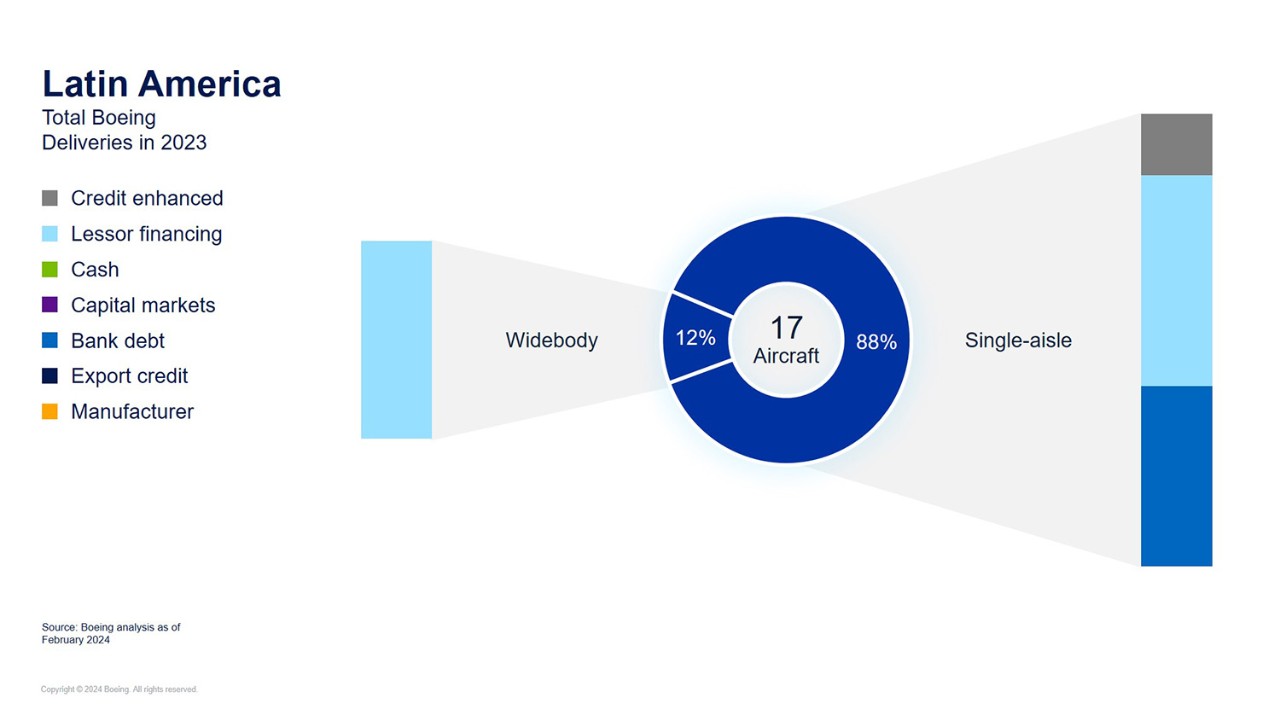

Latin America

Despite robust travel demand, Latin American airlines continue to face pressure from volatile foreign currency exchange rates. Lessors remain key to supporting Latin American deliveries.

2023 was a continued restructuring year for Latin American carriers, with most deliveries happening via direct lease or sale leaseback. Interest in financing Boeing deliveries will continue to outpace supply of aircraft, particularly for sale-leasebacks.

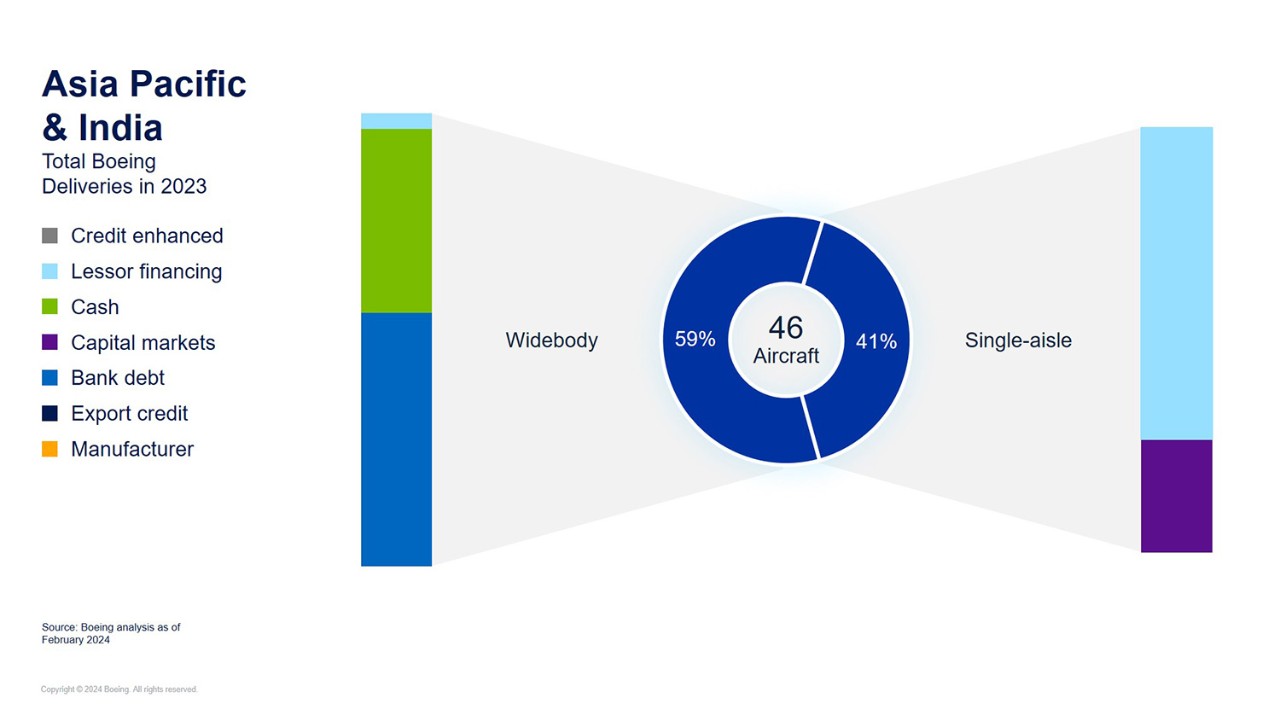

Asia Pacific & India

In 2023, volume of deliveries to the Asia Pacific and India region remained subdued compared to pre-pandemic levels.

Single-aisle deliveries were primarily to India-based carriers that relied on lessor financing, most commonly sale-leaseback transactions. We expect the reliance on lessor financing to continue to grow across the region as deliveries ramp up, particularly to customers in India and Southeast Asia. Asia-based lessors continue to raise funds in the capital markets through bond issuances for their single-aisle order book deliveries.

Widebody deliveries in the region were predominately to major full-service carriers who used bank debt or cash. In Japan in particular, we’ve seen customers paying for their deliveries with cash and later refinancing via JOLCO transactions or JBIC-guaranteed loans, and we expect this strategy to continue.

China

In 2023, deliveries to China remain significantly below pre-pandemic levels, especially with single-aisle aircraft.

Widebody deliveries in the region were primarily freighter aircraft that were paid for with cash or through bank debt. Our customers in the region maintain strong relationships with domestic banks and continue to see competitive pricing. We expect a similar trend with widebody deliveries to our Taiwanese customers.

Europe & Central Asia

Cash was the main source of delivery financing for single-aisle aircraft in 2023, as airlines continue to see increased yields and focus on deleveraging.

Lessors continue to be active in Europe and Central Asia, with both sale-leasebacks and lessor direct order placements. Lessor placements continue to be highly weighted with single-aisle aircraft.

Throughout 2023, lessors issued in the unsecured capital markets as having unencumbered aircraft on its respective balance sheets is a major factor in getting or retaining investment-grade ratings.

Export credit continued to play a key role in allowing airlines access to liquidity to acquire aircraft, especially for widebody deliveries.

Middle East

With abundant liquidity among the GCC banks owing to the sustained higher oil price, GCC banks are expected to increase exposure to the sector but will likely be limited to regional airlines and large lessors.

The steep rise in interest rates and considerable order books has prompted most of the carriers in the region to consider Export Credit Agency financing.

Africa

Development financiers play a bigger role in aircraft financing in the African region, with a number of African airlines still widely dependent on government support in one form or another. Lessors are actively considering new opportunities across the continent.

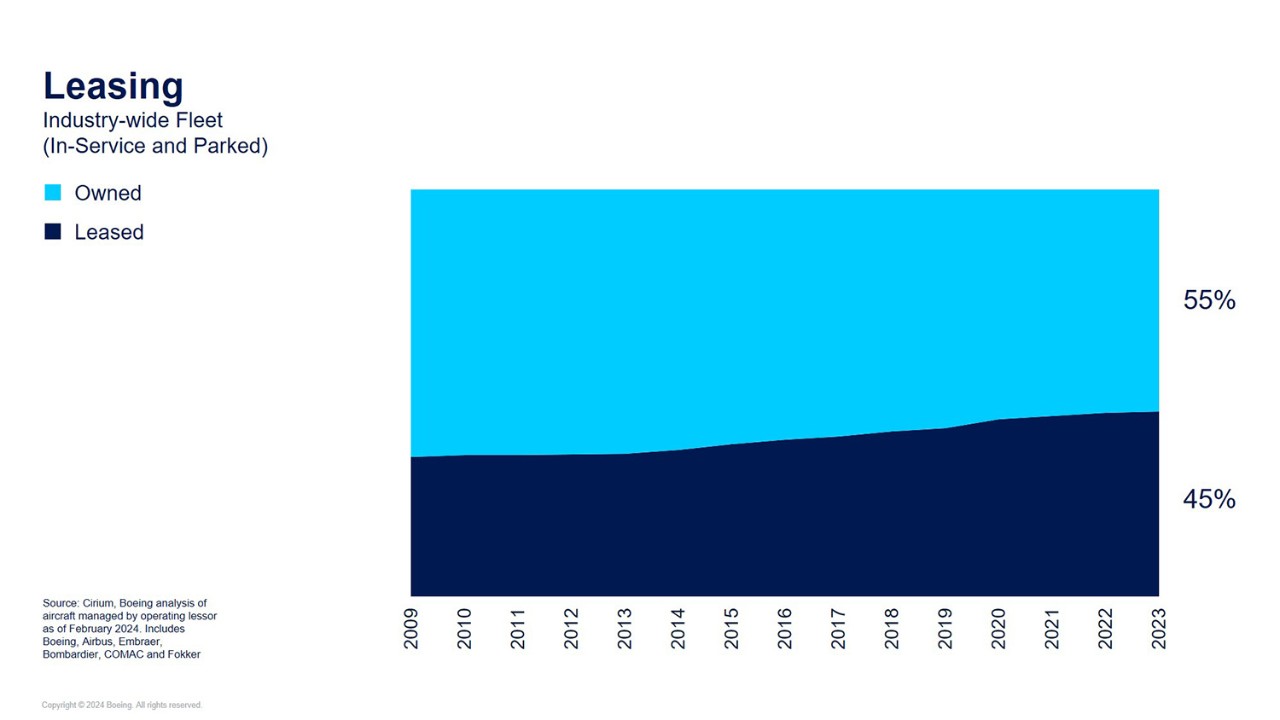

Leasing

- Leasing

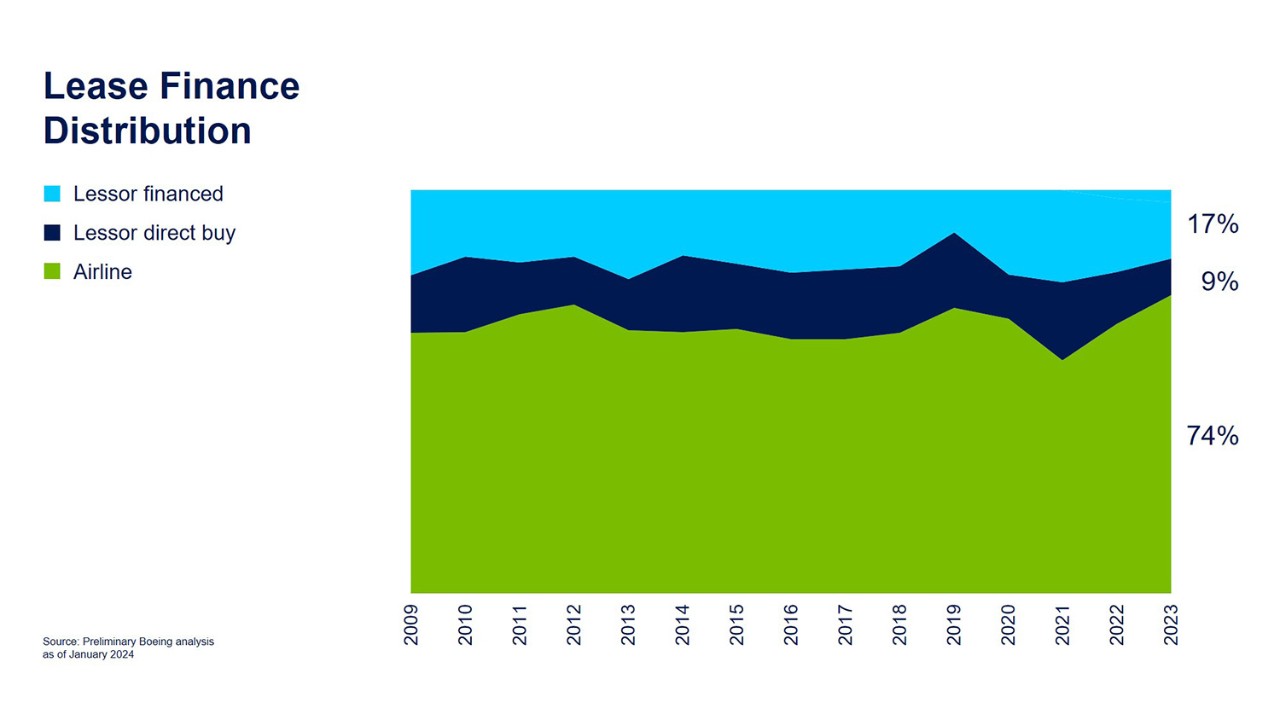

- Lease Finance Distribution

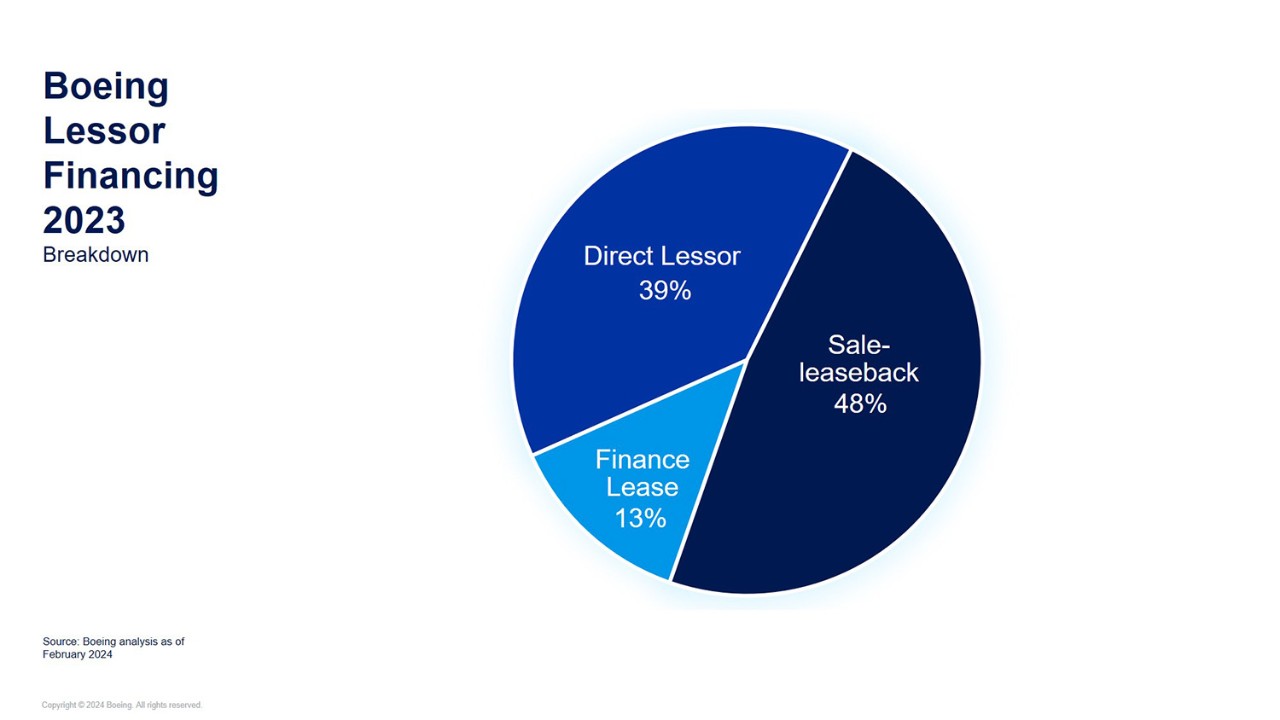

- Boeing Lessor Financing

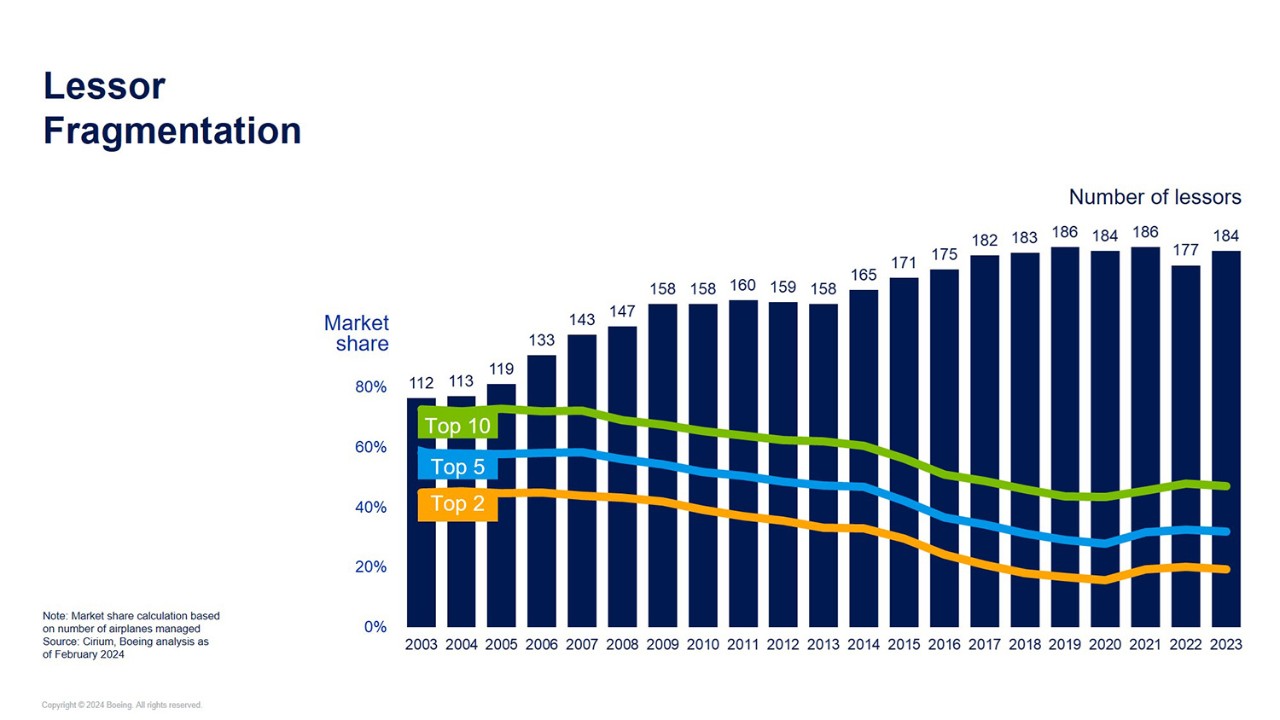

- Lessor Fragmentation

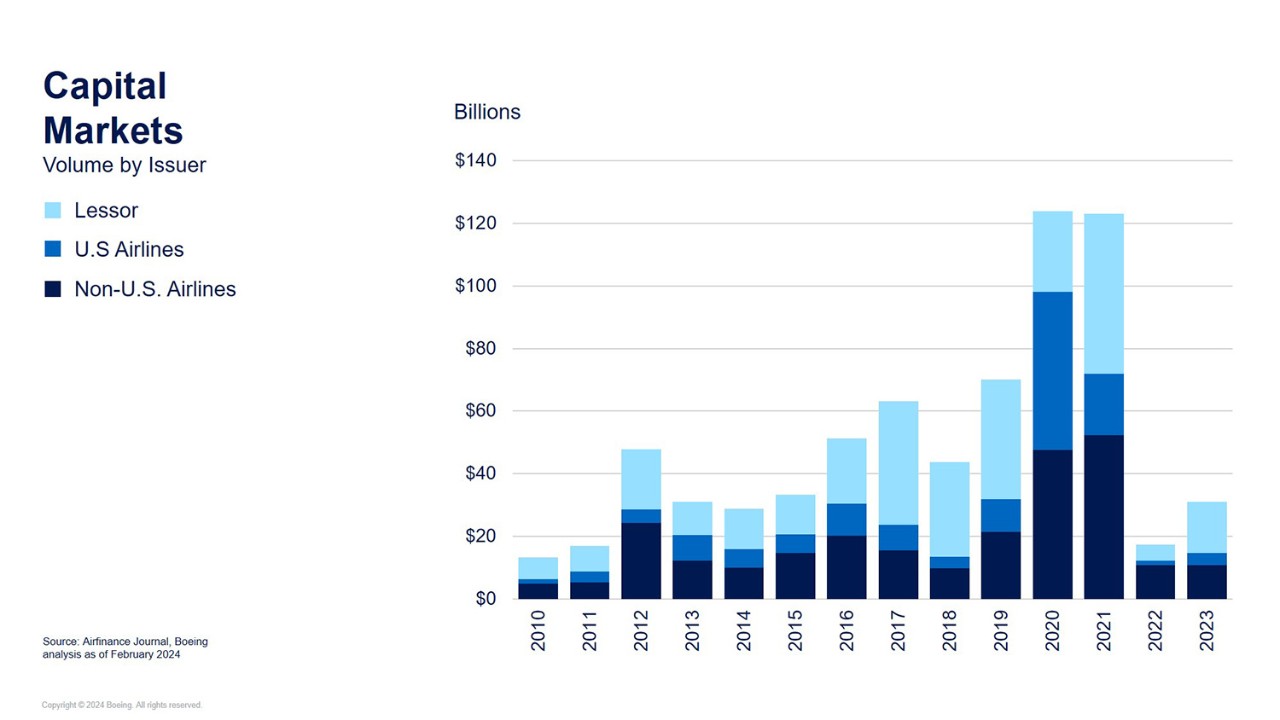

Capital Markets

Airlines took advantage of a period of attractive interest rates, developing liquidity buffers that have been increasingly deployed to finance aircraft purchases and capital investments. Recent improvements in credit metrics leave airlines well positioned to take advantage of an easing of capital markets as and when pricing begins to narrow from recently observed elevated levels.

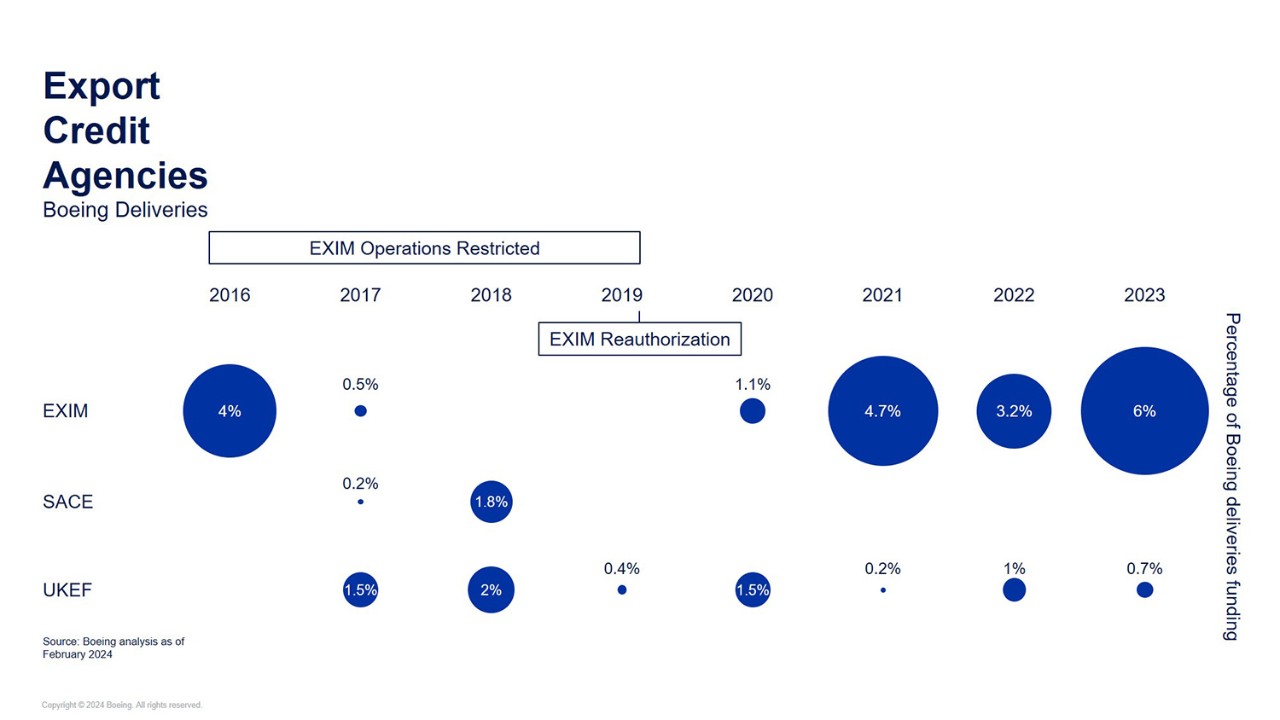

Export Credit Agencies

ECA funding has increased alongside an uplift in aircraft deliveries, and there is an expectation of further progress on financing of new aircraft into 2024. Competitive pricing continues to attract airlines to ECA financing and also supports funding diversification strategies.

Aircraft Value

- 737-8

- 787-9

- 777F

Air Cargo

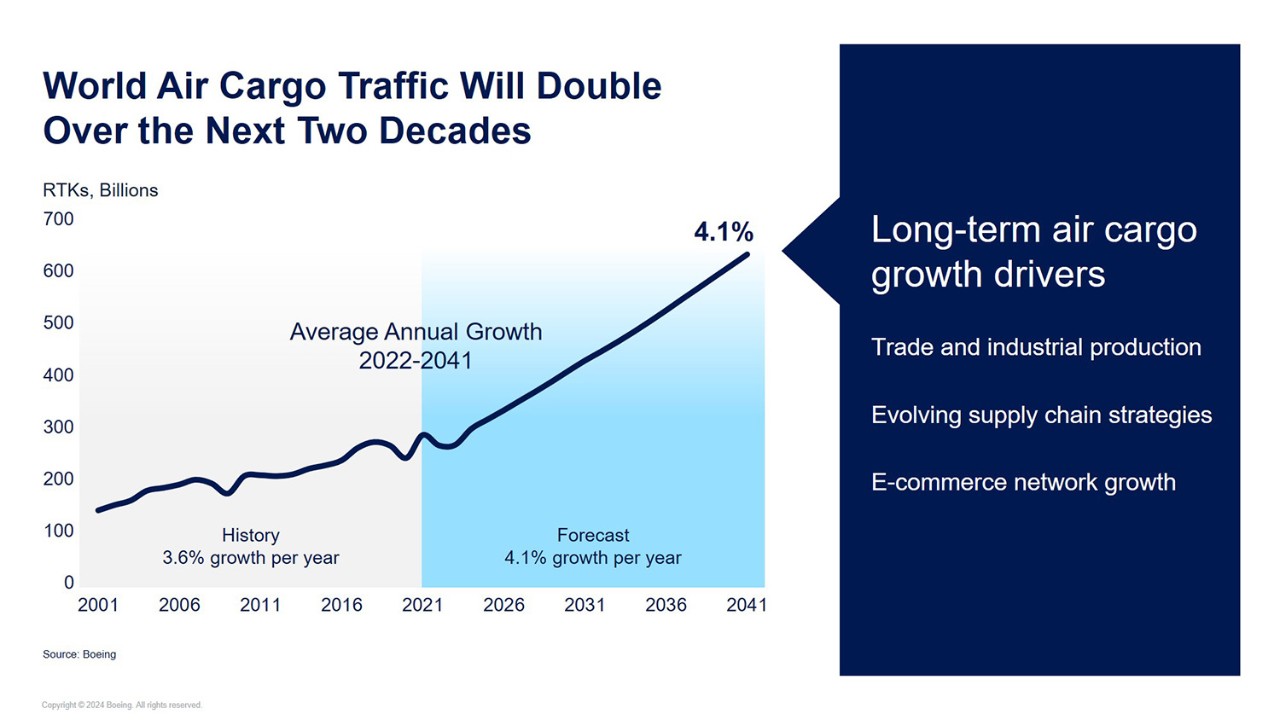

- World Air Cargo

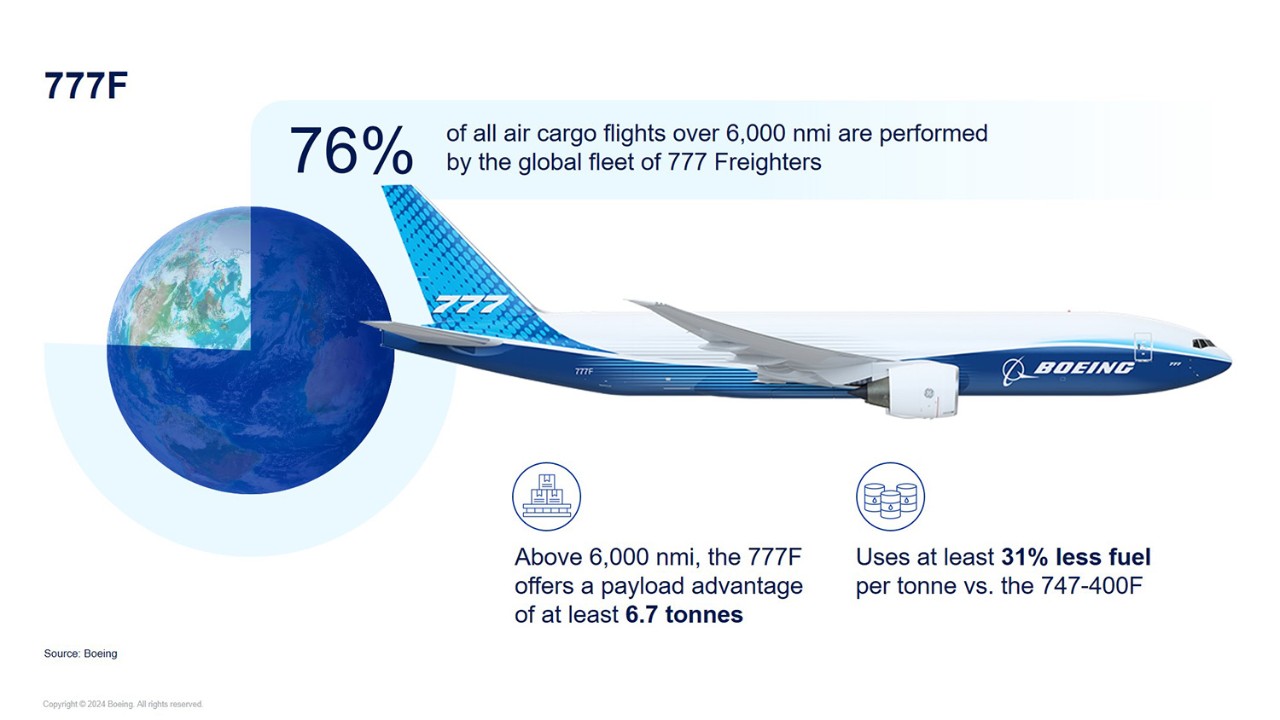

- 777F

Methodology

- Image 1

- Image 2

- Image 3